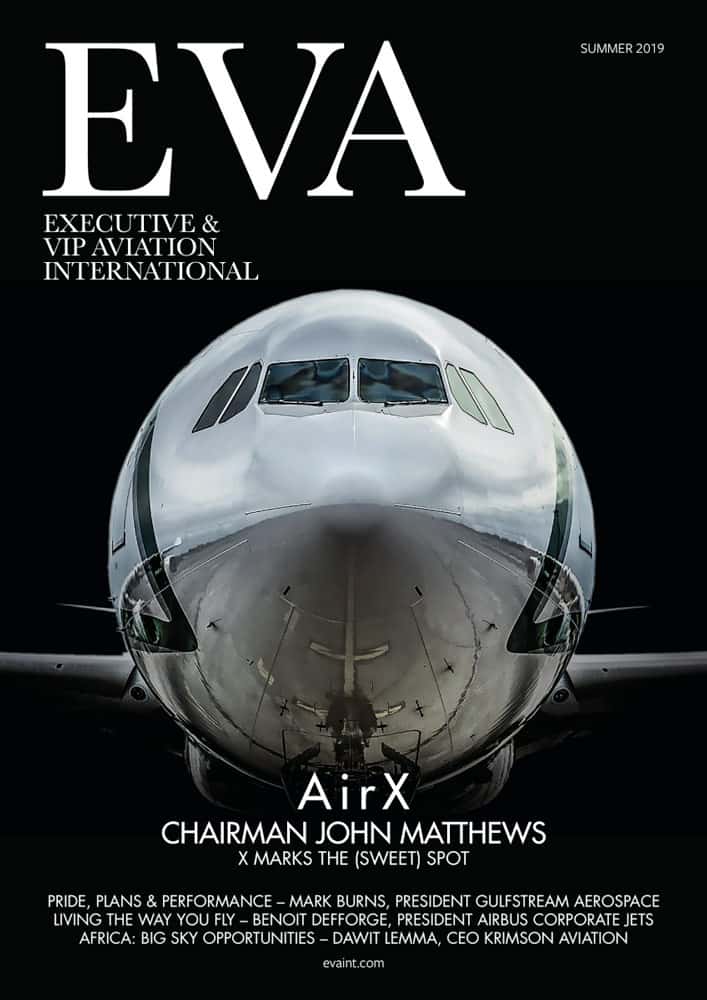

X Marks the (Sweet) Spot

Chairman John Matthews’s alternative view of the private aviation industry has seen him build AirX against the odds. Now, he’s looking to expand the fleet, while simultaneously preparing the company for it’s IPO.

AirX is an unusual company. It operates an unconventional fleet of corporate and VIP private jets. A self-styled ‘diversified airline’, it serves individuals and groups – numbering up to 100 passengers on one aircraft, in a single charter – from the worlds of entertainment, government and sport, and also specialises in discrete royal and WIP transport.

To arrive at its London office expecting just another semi-anonymous floor in a shared building is therefore naive. AirX does occupy a floor in a shared building, but the entrance is not on the same street as the address… It’s somehow appropriate for a business aviation charter specialist thriving in a difficult market, but not in quite the way one would expect.

AirX titles writ large announce you’ve arrived at the correct floor. And there are models, lots of them, depicting the aircraft it operates and some it doesn’t. This is evidently more than a charter operator. AirX is an air-minded company, with a real enthusiasm for aircraft and flying.

Over in Malta, AirX headquarters accommodates more than 110 staff over four floors of the Grand Harbour Marina; there are also offices in Germany and Fon Lauderdale.

But there’s no one at the reception desk in London. There’s no one there because the open-plan office space is immediately behind and it seems anyone not on the telephone – most people seem to be – is ready to jump up and greet visitors. Two folk respond to my appearance, the fastest of them, utterly nonplussed by my hopelessly late arrival, immediately striding off to see if Chairman John Matthews is ready for me.

A glass wall separates Matthews’s office from the open-plan area. It’s an unexpectedly welcoming space, equipped with a conference table and desk, but dominated by a wall-sized screen on which Matthews is finishing an email. We shake hands and he immediately dashes out to complete an urgent piece of business. Left alone in the office, all sons of possibilities present themselves but, instead, I say hello to the dog.

There’s a dog. I know nothing of dogs, but heseems friendly enough. Medium sized, he’s grey and white. The dog reads humans well it seems. After a cursory sniff, he dismisses me as unworthy and heads back to his bed.

I ask about him when Matthews returns . With disarming frankness, he shares the details of a profound family tragedy, explaining: “I wanted to return life to the house”. Gibson – the dog is named after Guy Gibson, a wartime Royal Air Force bomber pilot – is a springer spaniel, and he was that life. He goes home with Matthews’s every night, but has effectively become the office dog.

An Offer to Buy

The road to creating today’s AirX has been bumpy in the extreme. Driven by a passion for aviation, Matthews has recreated himself several times. As an owner pilot he began chartering his Piper Navajo Chieftain, and

himself. A chance encounter saw the business grow and acquire a Citation, but then fall foul of the 2008 economic slump. Declared bankrupt, Matthews sought aviation work in the Middle East.

Back in Europe and staying in a friend’s Munich flat, a conversation over a different dog led to Matthews first running and then buying AirX. Calling to ask if he might care for her dog while she and her husband were

away, his Munich neighbour revealed that the family airline business wasn’t going well. Matthews accepted board and lodging in exchange for running the ailing carrier and, six months later, offered to buy it.

Tireless hard work, an inspired team of professionals and a less than conventional outlook on business aviation and the charter industry have since helped him develop AirX to an annual revenue of just a little

under US$100 million. Later this year, with the help of some heavyweight banking expertise, he’s looking towards an initial public offering.

AirX’s success is established on Matthews’s refusal to buy new aircraft. The assets he purchases have already suffered the worst ravages of depreciation, but have considerable airworth iness remaining. After a cabin refurbishment and with the addition of the company’s exceptional service offering, each aircraft becomes seriously Matthews is a big fan of the Citation X, which he describes as ‘a rocket’ marketable, usually offering more cabin space or greater performance than similarly priced competition.

“As a pure operator,” Matthews says, “rather than a company operating aircraft for others, new aircraft make no sense. A brand-new US$6o-million jet is likely to depreciate by US$30 or US$40 million over four or five

years; I believe the rate of depreciation is extraordinary and the used market is saturated. I envisage a massive shift in the market over the next four years as the industry readjusts. I predict some painful, sobering changes, but they’ ll return the status quo we saw pre-2008 .”

It’s a somewhat apocalyptic point of view, but one Matthews substantiates by calling up data, graphs, used prices and more on the wall-screen. While some people talk ‘with their hands’, this man talks with the click of a mouse, summoning information from across the web and building a position that’s hard to deny. To a simple plane-loving writer he’s utterly convincing, but at the same time, he invites anyone to interpret the data differently.

Plane Talking

With photos of jets on-screen, the conversatio n quickly turns to aircraft, for which Matthews has a clear passion. “If I was buying myself a jet,” (a used one,presumably) he says, “I’d buy a Boeing, for its durability and cabin space. I enjoy cabin space. It’s why I like my Challenger 850s so much; they look like a Global inside, but with the width of the CRJ200.”

It’s a neat summing up of the AirX USP, offering more, or at least somet hing different in a good way, for the same or less money than the standard product. And yet AirX has its market niche pretty much to itself.

Where’s the competition?

Largely tied up as they work towards recouping the depreciation on aircraft they bought new, Matthews reckons.

Meanwhile, he says AirX has reached a mass that’s tricky to counter. “We’re at a size where we’re very difficult to compete with. A competitor wou ld need over 100 people in the back office, they’d need a tax-efficient, friendly area like Malta, a get-up-and-go civil aviation authority, like Malta, a European edge with airliners converted and a lessor that will lend in that sector, which is difficult, because most don’t want to know about older air craft. Finally, they’d need an understanding of maintenance bills, depreciation and finance that’s not based on new aircraft acquisition and operation.”

The sheer diversity of the AirX fleet is probably enough to dissuade most operators. It includes an Airbus A340, three Boeing 737s, a Lineage 1000, seven Challenger 850s, three Legacy 6oos and six Citation Xs. The

majority is on the Malta AOC, with the exception of a Challenger and four Citations, which operate on a German AOC, and two managed Citations on the US register.

AirX keeps its fleet busy and Matthews is looking at near-term expansion. His most recent acquisition, the Lineage 1000 joined the fleet early this year and immediately departed overseas on a block charter. Indeed,

it was put to work so rapidly that few in AirX have actually seen it and fewer still have been inside. The aircraft is so popular with the customer that an AirX spokesperson suggested ‘it might never come back’; at

the very least it won’t be available to other customers anytime soon.

Enthusiastically sharing more about his aeroplanes and operations, Matthews explains: ”We’re about to get a second A340. We’ve been working two years on it, but haven’t signed yet, so I won’t say it’s ‘done’. I also believe we shou ld see our US market grow now that we have an office there, although we don’t own our US-registered aircraft, we only operate them. “I think I’m done with buying aircraft that fly less than five hours, because they’re seasonal in popularity – we struggle with them in Q1 and Q4 – and there’s a lot of competition in the segment. I reckon I’ve 6 Executive & VIP Aviation International I Summer 2019 squeezed every bit of life out of my Boeings, my 737-5oos, too. I’ve kept them up with every piece of aviation legislation, but short of installing an EFIS cockpit I think I’ll have to replace them with New Generation aircraft over the next two years.

“And the Citation X? It’s a rocket! We have customers coming from an Excel… They’ve noticed their champagne tilts slightly under take-off acceleration and the climb out is fairly steep . In the Citation X the champagne lifts out of the glass… it’s amazing! But seriously, I think the diversity of AirX enables us to win in every climate in every sector, one at a time.

Orignally published from EVA Magazine Summer 2019